摘要:取消公摊后,物业费的计算方式将发生变化。具体税费计算需依据新的政策规定,可能会参考房屋的实际使用面积或按照其他合理的计量方式来收取物业费。相关税费计算细节需结合当地政策、物业合同及法律法规进行确定,以确保公平合理。建议业主关注当地政策动态,及时咨询物业管理部门或专业机构,了解具体的物业费税费计算方法。

Title: Designing a Solution for Property Fees and Taxes Calculation after Abolishing Common Area Fees

Abstract:

In the context of real estate management and property rights, the abolition of common area fees has sparked discussions on how to calculate property fees and taxes effectively. This article outlines a rapid problem design scheme in English, following the keywords "取消公摊后物业费税费咋算" (How to calculate property fees and taxes after eliminating common area fees), aiming to provide a structured approach to address this issue.

Introduction:

With the evolution of real estate management practices, the concept of common area fees has been under scrutiny. The removal of this fee structure presents a challenge in terms of recalculating property fees and taxes. This article proposes a design plan to address this challenge while ensuring fairness and transparency in the calculation process.

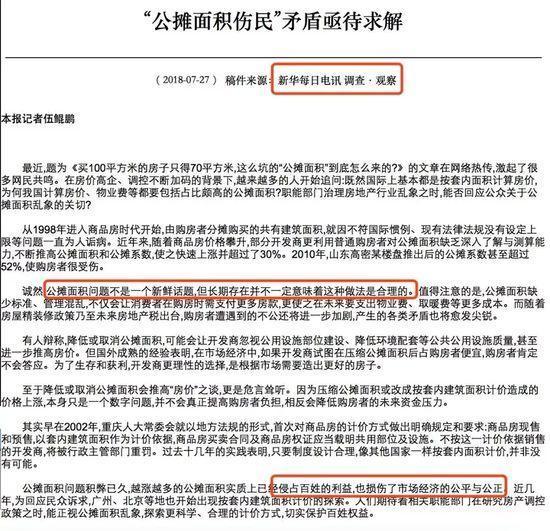

1、Understanding the Current Scenario:

Before formulating a design plan, it is imperative to understand the current situation and the impact of removing common area fees on property owners and management companies. This involves analyzing the existing fee structure, including the proportion of common area fees in total property costs and their role in overall property management.

2、Determining Key Elements:

The design plan should consider several key elements, including:

a. Property taxes: The design plan should consider how property taxes are calculated in the absence of common area fees. This could involve adopting a per-square-foot tax rate or considering other factors such as property value or location.

b. Service charges: In the absence of common area fees, service charges for amenities like elevators, security, and cleaning may need to be restructured to ensure fair distribution among property owners.

c. Cost allocation: A clear cost allocation mechanism should be established to ensure that all property owners bear their respective costs fairly. This could involve a transparent cost-per-square-foot approach or other methods based on usage or ownership type.

3、Developing a Design Plan:

Based on the above considerations, a design plan can be developed with the following steps:

a. Conduct a thorough assessment of the current fee structure and identify areas that need to be restructured or revised.

b. Develop a cost allocation model that considers factors like property size, location, amenities provided, and other relevant factors.

c. Determine an appropriate method for calculating property taxes based on local regulations and market practices.

d. Establish a clear and transparent process for calculating and collecting property fees and taxes, including regular reviews and adjustments to ensure fairness and sustainability.

e. Implement a system that allows property owners to understand their individual costs and contribute fairly to shared expenses such as maintenance and repairs.

4、Implementation Considerations:

The design plan should also consider practical implementation issues such as stakeholder engagement, communication strategies, training for management personnel, system upgrades for effective implementation, and compliance with regulatory requirements.

5、Evaluation and Feedback Mechanism:

It is essential to establish a mechanism to evaluate the effectiveness of the design plan and gather feedback from stakeholders, including property owners and management companies. This feedback can be used to make necessary adjustments or improvements to ensure optimal performance and satisfaction among stakeholders.

Conclusion:

The abolition of common area fees presents a challenge in terms of recalculating property fees and taxes. However, with a well-designed plan that considers key elements like property taxes, service charges, cost allocation, implementation considerations, and an evaluation and feedback mechanism, it is possible to address this challenge effectively and ensure fairness and transparency in the calculation process. This design plan outlines a structured approach to address this issue and facilitate smooth transition in real estate management practices.

鲁ICP备18003477号-1

鲁ICP备18003477号-1 鲁ICP备18003477号-1

鲁ICP备18003477号-1